Share this

May 2024 Market Commentary

by Wealthstone Group on Jun 04, 2024

Irrational Exuberance, Part Deax?

How do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions...?

-Alan Greenspan, "The Challenge of Central Banking in a Democratic Society."

Executive Summary

- The tech sector has continued to dominate returns both in May and over the YTD period.

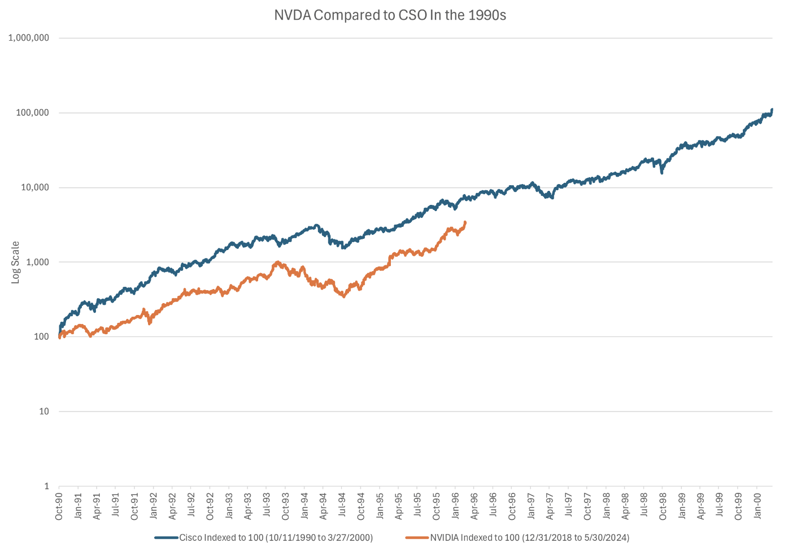

- Some of the trends seen in pricing in AI stocks is eerily similar to what was seen during the 1990s tech boom. While this does not necessarily mean a similar outcome, it is always worth keeping in mind what has happened in the past.

- The overall economy and market environment lends itself to the potential for favorable returns through the remainder of the year.

In May 2024, the US stock market exhibited mixed performance. The S&P 500 saw a gain of 4.11% through 5/30/24, driven by strong earnings reports from tech giants and resilience in consumer discretionary sectors. However, the Dow Jones Industrial Average remained relatively flat advancing 1.04%, while the Nasdaq Composite surged by 6.39%, benefiting from robust performance in the technology sector.

Economic Indicators:

- Inflation and Interest Rates: Inflation rates have continued to decelerate, with the latest CPI data showing a year-over-year increase of 3.4%. The Federal Reserve's efforts to control inflation appear to be yielding results, contributing to a more stable economic environment but inflation remains above the Fed’s targeted levels. We continue to see interest rates remaining close to current levels for the next several quarters.

- Employment: The unemployment rate changed slightly to 3.9%, with job gains in healthcare, social assistance and in transportation and warehousing. However, wage growth has slowed slightly, indicating a possible cooling in labor market pressures.

- Consumer Spending: As inflation continues to ease, consumer spending is expected to remain robust, supporting sectors like retail and services.

- Interest Rates: The Federal Reserve may maintain its current interest rate policy if inflation continues to decrease, which could provide a stable environment for equities.

- Geopolitical Risks: Ongoing geopolitical tensions, particularly related to trade policies, could introduce volatility. Investors should remain cautious of potential disruptions.

- Energy Sector Volatility: Fluctuations in oil prices due to geopolitical factors and supply chain issues may impact the energy sector, contributing to market volatility.

Tech Sector Dominance: With ongoing advancements in AI and cloud computing, the technology sector is poised to continue its upward trajectory. Companies leading in these innovations may continue to outperform. History never truly repeats itself but much of the AI mania of late is reminiscent of the irrational exuberance of the 1990s. The chart below shows Cisco during the 1990s to the top of the bubble compared to NVIDIA from the beginning of 2019 to 5/30/24. If NVIDIA follows the same path as Cicco in the 1990s, this chart would indicate that maybe we are just getting started on the AI boom. But it is worth keeping in mind that from 3/27/2000 to 3/31/2003, Cisco had an annualized return of -45.4% or a total return of -83.8%. A closely replicated return stream for NVIDIA as seen with Cisco would necessitate either being extremely successful in timing the top of the market or participating in the rally but in a diversified manner. We believe there is great potential for AI, but as students of market history have seen numerous times where a particular stock got ahead of itself with investors suffering the hangover of returns following a peak. Patient investors in Cisco did eventually get back to where they were in March of 2000, but it did take until the end of 2021.

Overall, we believe the US stock market will remain resilient, supported by strong economic fundamentals and a favorable monetary policy environment. However, investors should stay alert to potential risks and market corrections.

Louis Tucci; Partner | Senior Investment Advisor

Paulo Aguilar, CAIA; Partner | Senior Investment Advisor

Mark H. Tucker, CFA; Portfolio Manager

David Crook; Macro Economist

Securities offered through Arkadios Capital. Member FINRA/SIPC. Advisory services through Arkadios Wealth.

Past performance does not guarantee or is indicative of future results. This summary of statistics, price, and quotes has been obtained from sources believed to be reliable but is not necessarily complete and cannot be guaranteed. All securities may lose value, may not be insured by any federal agency and are subject to availability and price changes. Market risk is a consideration if sold prior to maturity. Information and opinions herein are for general informational use only and subject to change without notice.

This material does not constitute an offer to sell, solicitation of an offer to buy, recommendation to buy, or representation as the suitability or appropriateness of any security, financial product or instrument, unless explicitly stated as such. This information should not be construed as legal, regulatory, tax, personalized investment, or accounting advice.

The information is current only as of the date of this communication and we do not undertake to update or revise such information following such date. To the extent that any securities or their issuers are included in this communication, we do not undertake to provide any information about such securities or their issuers in the future. The views expressed reflect the author(s) personal view and not the view of Arkadios Capital or Arkadios Wealth. This report is provided on a “where is, as is” basis, and we expressly disclaim any liability for any losses or other consequences of any person’s use of or reliance on the information contained in this communication.