Share this

January 2026 Market Commentary

by Wealthstone Group on Jan 06, 2026

Not every headline is a turning point. Some are just Hawaiian Shirt Day.

Executive Summary

- Headlines versus reality: Despite elevated geopolitical and policy noise, markets continue to distinguish between symbolism and substance. Recent developments, including changes at the Federal Reserve and events in Venezuela, have generated more media attention than market movement.

- Positioning over prediction: We remain constructive on risk assets, with a selective overweight to technology and AI, a continued domestic equity bias, and an emphasis on diversification as valuations remain elevated and leadership continues to be concentrated.

- Discipline matters more than volume: Slowing growth, resilient margins, and compressed spreads argue for precision across portfolios. This is an environment where manager selection and selectivity matter more than broad exposure.

In the movie Office Space, Hawaiian Shirt Day is management theater. It looks like action, sounds like progress, but ultimately changes nothing. Markets often behave the same way. Headlines arrive with urgency, commentary escalates quickly, and yet prices respond only when something genuinely alters the underlying math. That distinction between noise and signal has defined the opening of 2026.

What the Returns Are Telling Us

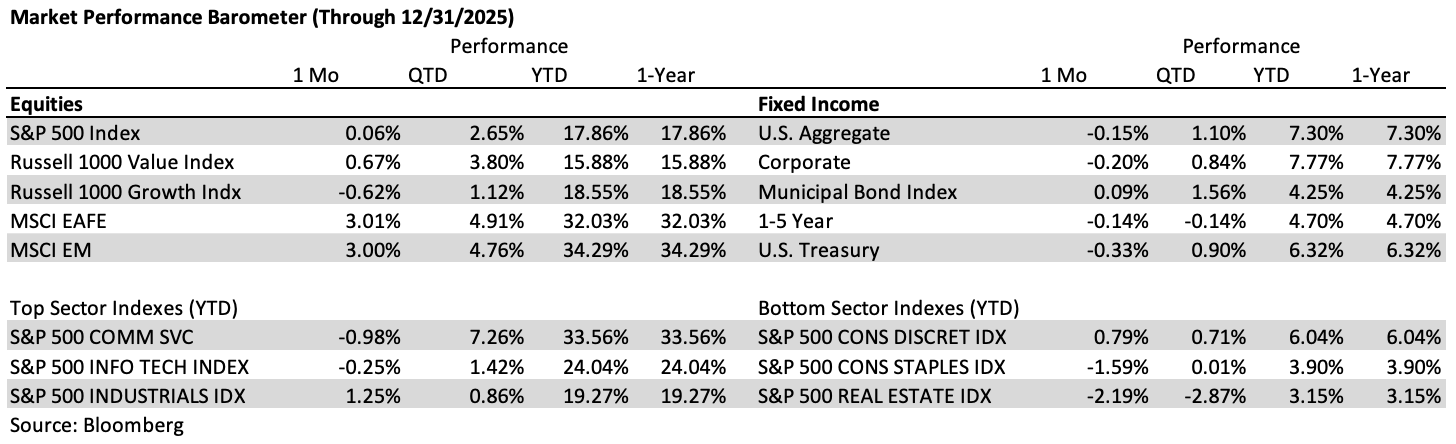

Market performance through year-end 2025 reflected a constructive but uneven environment across asset classes. U.S. equities delivered solid double-digit returns, with the S&P 500 up nearly 18% for the year. Performance was not driven by speculative excess, but by continued earnings resilience and margin durability, particularly among larger, higher-quality companies.

Leadership within equities mostly broadened. While growth stocks continued to perform well, value also contributed positively, and international equities meaningfully outperformed U.S. markets. Developed international and emerging market equities both posted returns north of 30% for the year, aided by a weaker U.S. dollar, improving global growth expectations, and more stable policy backdrops abroad. Performance was strong, but not linear.

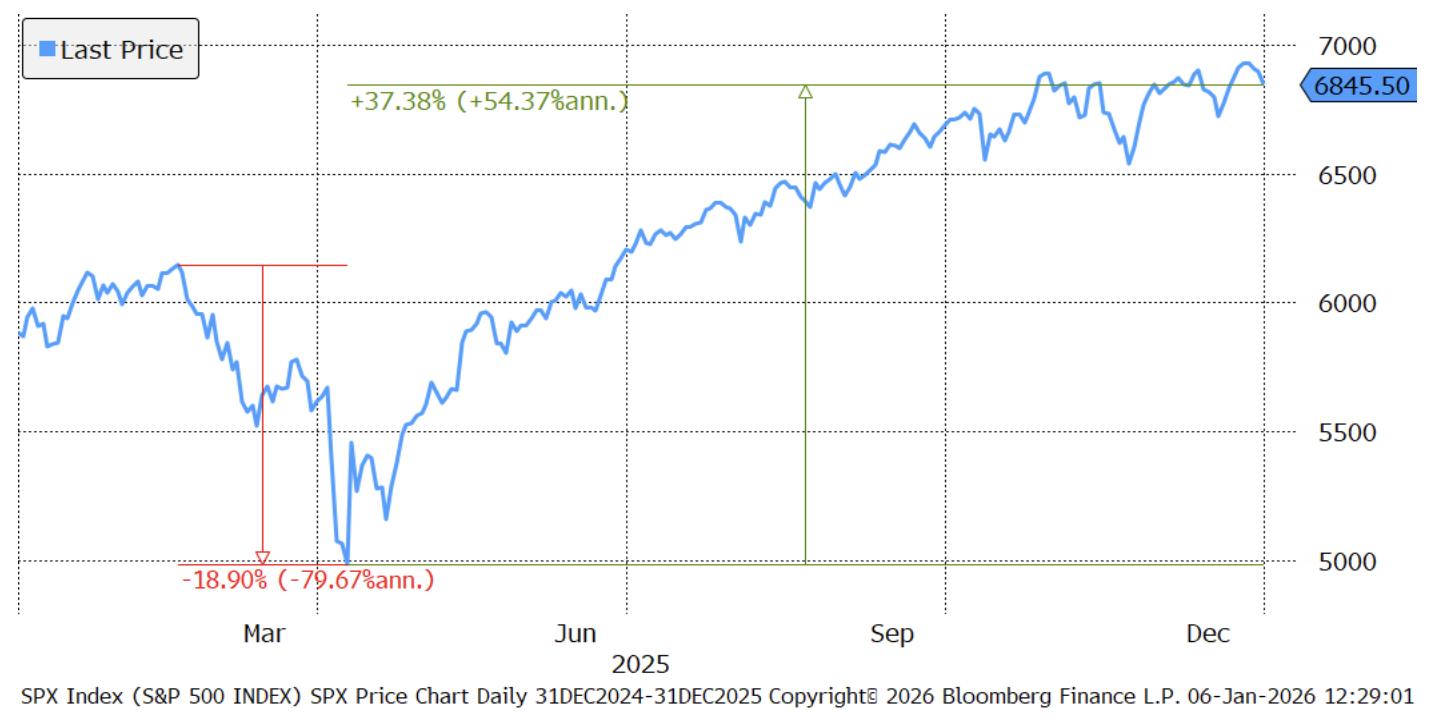

While the market as a whole notched another positive year or returns, the S&P 500 price chart below highlights that markets do not move in a straight line. We saw sharp drawdown following initial tariff announcements and patient investors were well rewarded by looking through the noise. The volatility also highlights the need for proper risk control and diversification so that emotions do not force rash decisions.

Fixed income quietly rebuilt its role as a source of return. Core bonds delivered mid-single-digit gains, while corporate credit outperformed on steady fundamentals and contained default expectations. Treasury returns were positive despite rate volatility, underscoring the benefits of carry in a stabilizing yield environment. Municipal bonds also posted positive results, reinforcing their role as a defensive ballast.

At the sector level, dispersion remained pronounced. Communication services and technology continued to lead, reflecting ongoing investment in digital infrastructure and AI-related spending. Industrials also posted solid gains, supported by capital spending and infrastructure demand. On the other end of the spectrum, consumer staples and real estate lagged, pressured by rate sensitivity and more muted growth dynamics. The overall message from returns is consistent with the broader market backdrop: risk assets were selectively rewarded. Broad participation improved, diversification mattered, and fundamentals carried more weight than headlines.

Federal Reserve: New Chair, Same Constraints

The imminent appointment of a new Federal Reserve Chair has generated predictable speculation about a shift in monetary policy. Markets, however, have responded with restraint. Interest rate probabilities remain tightly clustered, and expectations for policy easing have changed little. Bloomberg’s World Interest Rate Probability continues to imply a gradual path forward rather than a dramatic pivot. A change in leadership may bring a different tone, but the constraints facing policy remain unchanged. This, too, looks less like a turning point and more like a change in dress code.

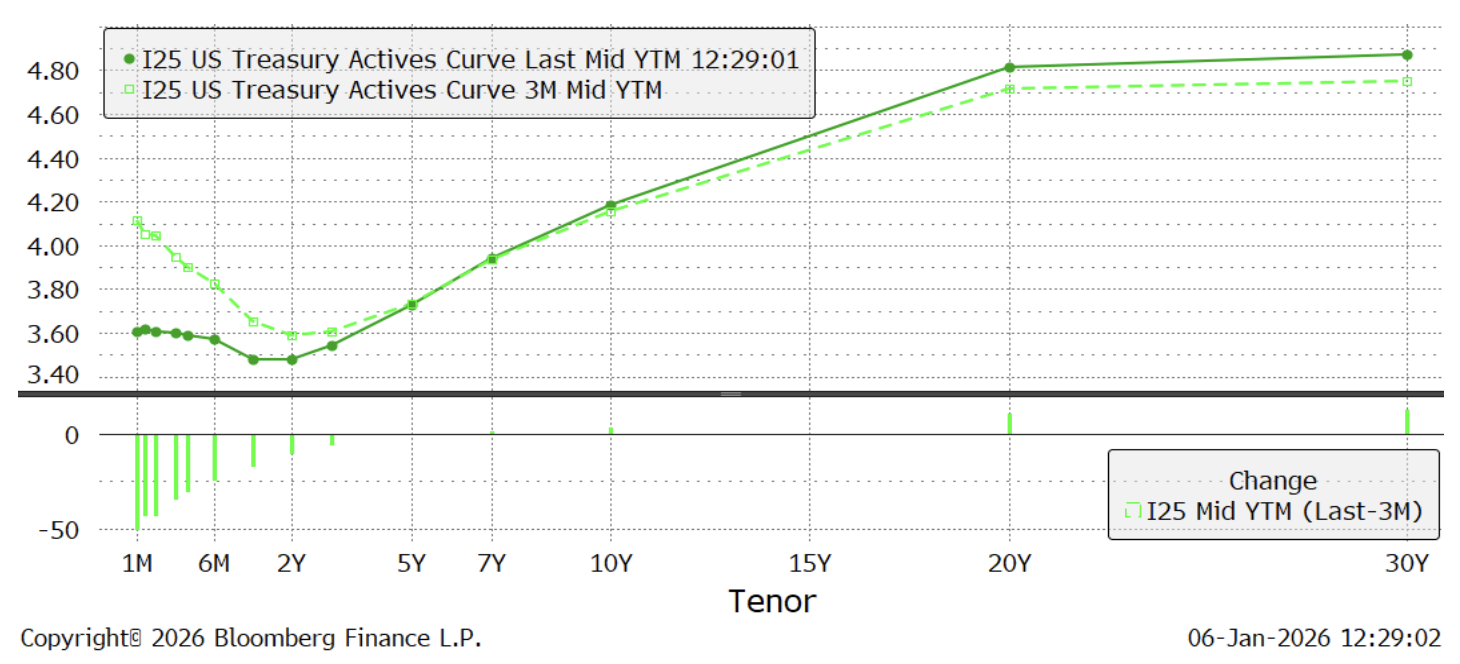

Along with the recent rate cuts, we have seen significant normalization in the term structure of the rate curve. The front end of the curve has compress significantly, making slightly extended duration more attractive on a risk adjusted basis. The yield curve has demonstrated a will to steepen in the recent past.

Asset Class Performance: Broadly Constructive, Narrowly Led

Across asset classes, performance in 2025 reflected balance rather than excess. U.S. equities delivered strong returns, supported by resilient earnings and steady margins. International equities participated, particularly in emerging markets, though dispersion remained wide. Fixed income reasserted its role as yields stabilized, while credit performed adequately despite compressed spreads. Markets rewarded fundamentals, not fanfare.

Tariffs: Persistent Noise, Limited Damage

Trade policy once again featured prominently in headlines over the past year. While tariffs remain a meaningful geopolitical tool, their economic impact has been more measured than initially feared. Supply chains adjusted incrementally, inflationary effects remained contained, and markets largely looked through the rhetoric. The result was volatility without disruption. Loud, yes. Transformative, no.

Venezuela: A Tail Risk Quietly Removed

The removal of Nicolás Maduro from power in Venezuela is another example of markets distinguishing between spectacle and substance. While geopolitically significant, the event was met with a muted response from risk assets. Energy markets remained stable, and broader sentiment improved modestly. Investors appeared to view the development less as a shock and more as the resolution of a long-standing uncertainty. Take the Cuban Missile Crisis, markets fell 5% on the headline, but were down just 1% by the end of the 12-day standoff. A reminder that not every dramatic headline translates into systemic risk.

Technology and AI: Precision Over Volume

We remain long-term bullish on artificial intelligence and technology as structural drivers of growth and productivity. At the same time, near-term volatility is inevitable given elevated valuations and concentrated leadership. This is a sniper environment, not a machine-gun burst. We are maintaining an overweight to the space, but with a focus on selectivity, balance sheets, and earnings durability rather than thematic enthusiasm alone.

Geographic Positioning: Opportunity Abroad, Bias at Home

International markets continue to screen attractively on valuation, but we are maintaining domestic bias. U.S. companies benefit from scale, innovation, and a disproportionate share of AI-driven investment. Select international exposure makes sense, but wholesale rotation remains premature.

Margins, Growth, and the 2026 Outlook

Corporate margins have remained resilient, aided in part by productivity gains from technology adoption. While economic growth is likely to slow modestly in 2026, it does so from a position of strength. This is a normalization, not a downturn. Markets appear comfortable with that distinction.

Valuations and Concentration Risk

We remain firm in avoiding excessive concentration in growth and AI. Valuations are full, and expectations are high. Diversification remains essential, particularly in an environment where confidence often arrives faster than evidence.

Private Markets: Skill Over Scale

The easy phase of private credit is behind us. With spreads compressed, outcomes increasingly depend on manager skill rather than market beta. Attractive opportunities remain for focused, disciplined managers, but broad exposure alone is no longer sufficient.

In private equity, a large cohort of 2020–2022 vintage funds is approaching expected exit windows, increasing the need for liquidity. While M&A activity shows early signs of reopening, exit conditions remain uneven, particularly for assets underwritten at peak 2021 valuations. Higher financing costs, compressed multiples, and selective buyer demand continue to complicate traditional exits, elevating the role of secondary transactions and specialist liquidity providers. In this environment, quality and patience are being rewarded.

Private real estate markets remain highly fragmented by property type, geography, and capital structure. Higher rates and tighter credit have pressured valuations, especially for over-levered or structurally challenged assets, while well-located properties with durable cash flows have proven more resilient. Transaction volumes remain below historical norms, but refinancing constraints and motivated sellers are creating selective entry points for well-capitalized investors. Success increasingly depends on conservative leverage, asset-level discipline, and experienced managers navigating operational complexity.

Don’t let Hawaiian shirts fool you. Durable returns in private markets are still forged through underwriting, not optics.

Bottom Line

Markets enter 2026 with an unusual combination of skepticism and discipline. Policy changes are incremental, geopolitical risks are being absorbed, and fundamentals continue to matter. In an environment where headlines often resemble Hawaiian Shirt Day, the opportunity lies in recognizing the moments that actually change the plot.

Louis Tucci; Partner | Senior Investment Advisor

Paulo Aguilar, CFA, CAIA; Partner | Senior Investment Advisor

Mark H. Tucker, CFA; Chief Investment Officer

Chuck Bettinger; Portfolio Manager

Securities offered through Arkadios Capital. Member FINRA/SIPC. Advisory services through Arkadios Wealth.

Past performance does not guarantee or is indicative of future results. This summary of statistics, price, and quotes has been obtained from sources believed to be reliable but is not necessarily complete and cannot be guaranteed. All securities may lose value, may not be insured by any federal agency and are subject to availability and price changes. Market risk is a consideration if sold prior to maturity. Information and opinions herein are for general informational use only and subject to change without notice.

This material does not constitute an offer to sell, solicitation of an offer to buy, recommendation to buy, or representation as the suitability or appropriateness of any security, financial product or instrument, unless explicitly stated as such. This information should not be construed as legal, regulatory, tax, personalized investment, or accounting advice.

The information is current only as of the date of this communication and we do not undertake to update or revise such information following such date. To the extent that any securities or their issuers are included in this communication, we do not undertake to provide any information about such securities or their issuers in the future. The views expressed reflect the author(s) personal view and not the view of Arkadios Capital or Arkadios Wealth. This report is provided on a “where is, as is” basis, and we expressly disclaim any liability for any losses or other consequences of any person’s use of or reliance on the information contained in this communication.